Money tells a story. One number can say a lot. That number is net worth. It shows your full financial picture. It adds what you own. Then subtracts what you owe. That’s your net worth. The median net worth by age helps you compare. It tells where most people stand. Not the rich. Not the poor. Just the middle. It gives real goals. It shows if you are ahead. Or if you need to grow. In this blog, we break it all down. You’ll learn what net worth means. You’ll see how it changes by age. And you’ll find smart tips to improve it. Use this guide to plan better. To save more. And to build your future.

What Is Net Worth?

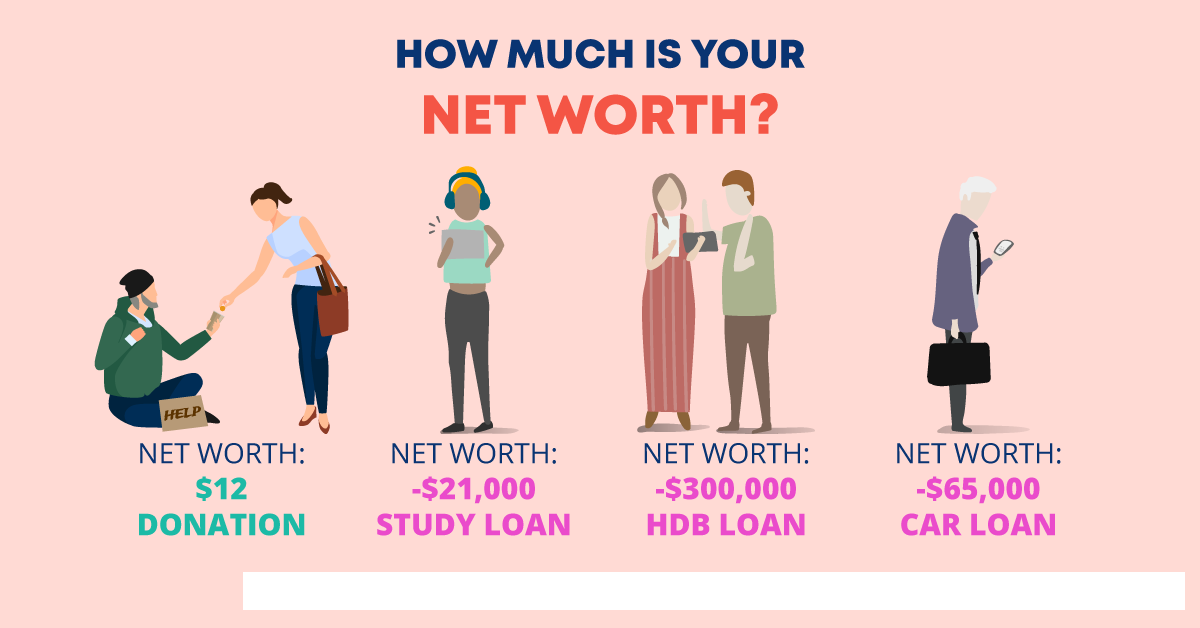

Net worth is a simple idea. But it holds power. It shows how much you truly have. And what you owe. It’s not your income. It’s not your savings alone. It’s all assets minus all debts. This number tells your financial story. And that’s why it matters. Add your assets. That could be money, home value, or car. Subtract what you owe. Like loans or credit cards. The number you get? That’s your net worth. The median net worth by age shows how others your age compare. If the number is positive, that’s good. If negative, you owe more than you own. Either way, you know where you stand.

Median Net Worth by Age Breakdown

When people ask, “How am I doing?” they want a real comparison. That’s what median net worth by age gives. It’s the middle point. Not the average. Not the extreme rich. This number tells what a typical person your age might have. It’s a better mirror. One that helps set real goals.

Household Median Net Worth by Age:

| Age Group | Median Net Worth |

| Under 35 | $39,000 |

| 35–44 | $135,600 |

| 45–54 | $247,200 |

| 55–64 | $364,500 |

| 65–74 | $409,900 |

| 75 and above | $335,600 |

This table shows how net worth grows. People earn, save, and invest. Then, after retirement, savings are used. So net worth may drop.

Comparing Average vs Median Net Worth by Age

Many use average net worth. But it’s not the best tool. That’s because high net worths skew the number. The median is better. It cuts out the extremes. It shows what’s normal. And that helps you compare better. The median net worth by age shows what half of people have less than and half have more than.

Average Median Net Worth by Age:

| Age Group | Average Net Worth |

| Under 35 | $183,500 |

| 35–44 | $549,600 |

| 45–54 | $975,800 |

| 55–64 | $1.57 million |

| 65–74 | $1.79 million |

| 75 and above | $1.62 million |

This shows big jumps. But it doesn’t mean everyone’s there. That’s why we rely on the median.

How Median Net Worth by Age Increases Over Time?

As people get older, they usually earn more money. Early in life, most people start with little savings and some debt. But over time, they find better jobs and earn higher incomes. This helps them save and invest more. They also start paying off loans like student debt or mortgages. Investments, like retirement accounts, begin to grow with time. This growth adds to their total wealth. Many people buy homes, which also increase in value. These actions build their net worth slowly and steadily. That’s why net worth often rises as people age. It’s the result of years of saving, working, and planning.

Role of Retirement Savings in Median Net Worth by Age

Retirement accounts are key. They make up part of net worth. People save in 401(k)s and IRAs. This adds to long-term wealth.

Average 401(k) by Generation:

| Generation | Avg. 401(k) Balance |

| Baby Boomers | $242,200 |

| Gen X | $182,100 |

| Millennials | $62,000 |

| Gen Z | $12,000 |

These numbers highlight the need to save early. Small steps now lead to big results later. Retirement accounts are important in building the median net worth by age.

Smart Ways to Grow Median net worth by age

Small actions build real wealth over time. You don’t need to be rich to grow money. Just make better decisions, bit by bit.

1. Trim Daily Expenses

Cutting costs helps you save more. Start by listing where your money goes. See if there’s anything you don’t really need. Maybe it’s a subscription. Or takeout meals too often. Try eating at home more. Cancel things you don’t use. Even little cuts add up fast.

2. Build Emergency Savings

Unexpected bills always come. Having backup cash helps. Try saving $1,000 to start. Then aim for three months of expenses. Keep this money in a separate account. Don’t touch it unless it’s a real emergency. This fund gives peace of mind. You won’t need loans for surprise costs.

3. Pay Off High-Interest Debt

Debt makes saving harder. Especially if interest is high. Credit cards are the worst. Focus on paying them off first. Always pay more than the minimum. Try not to add new charges. As debt goes down, savings can go up. Less debt means more control.

4. Start Investing Early

Time is your best tool. The earlier you invest, the more you earn. Even small amounts grow big over time. Use a simple plan. Stick to it every month. If your job offers help, take it. That’s money you don’t want to miss. Just get started. It matters.

Smart Accounts That Help Improve Median Net Worth by Age

Where you put your money matters. Some accounts grow faster. Others offer better safety. Choosing well helps your money work harder.

1. Try HSAs

Health savings accounts are very useful. They let you save for health costs. The money goes in before taxes. That means more in your pocket. If you don’t use it now, it grows over time. Some accounts even earn interest or grow with investments. They work best if you stay healthy and let the money sit.

2. Use Brokerage Accounts

These accounts are flexible. You can invest for any goal. There are no strict rules like retirement accounts. No limits on how much you put in. You can use the money anytime. It’s good for things like a home, business, or travel. Just know that your gains may be taxed.

Employer Benefits That Boost Median Net Worth by Age

Jobs offer more than just pay. Many give extras that help you save. But you must know what to look for.

1. Explore Retirement Perks

Some jobs match your savings. That’s free money. Always try to get that match. It adds up over time. Some plans also offer tools to help you invest. Use those too. The earlier you start, the more you’ll have later.

2. Check Health and Loan Help

Some jobs offer help with student loans. Others give money for health care. These perks lower your costs. That leaves you with more to save. Some even help you plan for the future with advice or support.

Withdrawal Strategy and Protecting Your Median Net Worth by Age

How you take money out matters. It affects how long your money lasts. A smart plan keeps more in your hands.

1. Spread Withdrawals Over Time

Don’t take too much at once. That could mean more taxes. Try to take steady amounts yearly. Spread it across different accounts. This helps you stay in a lower tax group. It also makes your money last longer.

2. Think About Taxes

Some accounts are taxed when you take money. Others aren’t. Knowing the difference saves you money. Try pulling from accounts with the highest taxes last. That way, you pay less early on. Every bit you keep adds time to your savings.

Final Words:

Let’s wrap it all up. Your net worth is your financial health. It shows where you are. And what needs work. The median net worth by age helps you compare. It shows real numbers. Not just averages. But the actual middle. That’s how you track progress. You don’t need to be rich to grow it. Save what you can. Pay off what you owe. Use accounts that help. Take job benefits. Plan for retirement. Start now. Even small steps matter. Know your number. Grow your future. The right moves today change tomorrow. Track it yearly. Make it a goal. And use this as your guide. Your net worth will rise and you’ll feel the difference.